To fast track the distribution of public and social services to beneficiaries, Senator Win Gatchalian is proposing that government financial institutions create a bank account for every unbanked Filipino.

“Sa ilalim ng panukalang ito, mas mapapadali na ang pamimigay ng ayuda dahil derecho na ito sa mismong bank account ng mga benepisyaryo at hindi na kailangang pumila pa,” Gatchalian said in filing Senate Bill No. 808 or One Filipino One Bank Account Act.

“Sa pamamagitan din nito, mas madaling matututo ang ating mga kababayan na gumamit ng bangko at ng mga online facilities para sa iba-t ibang transaksyon tulad ng pagbabayad ng bills o mga bilin at para mag-impok,” he added.

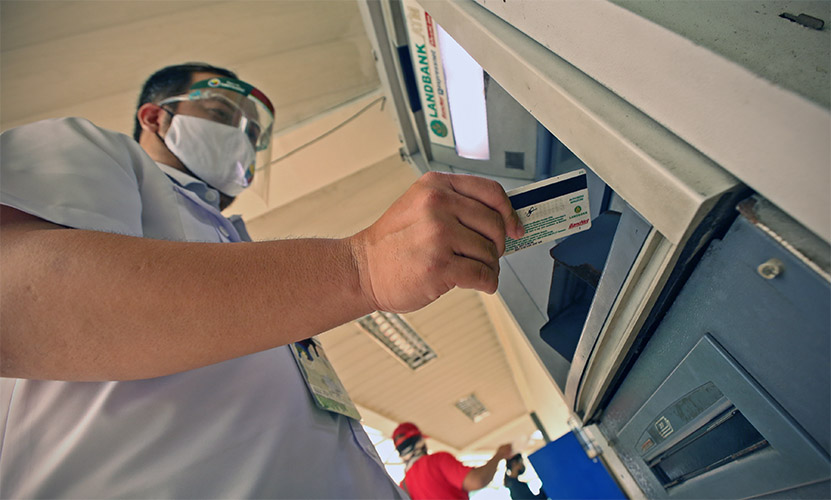

The proposed measure, which the senator refiled this 19th Congress, seeks to mandate government financial institutions, such as Land bank of the Philippines (Landbank) and Development Bank of the Philippines (DBP), to open and maintain a bank account for every Filipino to access financial services provided by the government including educational assistance and other forms of subsidy.

Gatchalian said the measure will work side by side with the Community-Based Monitoring System (CBMS) Law, a system that gathers information from all households in the community that is local government unit-based, starting at the barangay level.

“Dahil sa inaasahang mas mabilis na koordinasyon mula sa mga barangay ng bawat lokal na pamahalaan, magiging synchronized ang galaw. Maiiwasan din nito ang kaguluhan at mapapanatili ang kaayusan sa pamimigay ng tulong pinansyal sa mga kababayan nating nangangailangan,” Gatchalian said.

While the Philippine National ID addresses an individual’s lack of documentary requirements for opening a bank account, Gatchalian said the government still needs to facilitate and strengthen the financial inclusion landscape in the Philippines and to promote seamless, efficient, transparent, and targeted delivery of public and social services.

The Bangko Sentral ng Pilipinas (BSP) 2019 Financial Inclusion Survey showed that only 28.6% of the respondents 15 years old and above have a formal account which includes bank, e-money, cooperative and microfinance institutions accounts, and only 12.2% of these respondents have bank accounts. The same survey showed that 71% have difficulty in opening an account due to documentary requirements and 58% do not have the requirements for their loan applications in a formal financial institution.