Senator Win Gatchalian warned financial service providers anew, including online lending platforms, against continuing with their abusive debt collection practice, as he vowed to pursue the legislation criminalizing such acts.

“Masyado nang mapangahas ang ibang lending companies na nagsulputan. Hindi sila titigil hangga’t walang batas na magpapanagot sa mga maling gawain nila. Umaabot pa sa puntong pamamahiya at paninirang puri ang ginagawa nila sa mga nangutang sa kanila para lang makasingil,” he said.

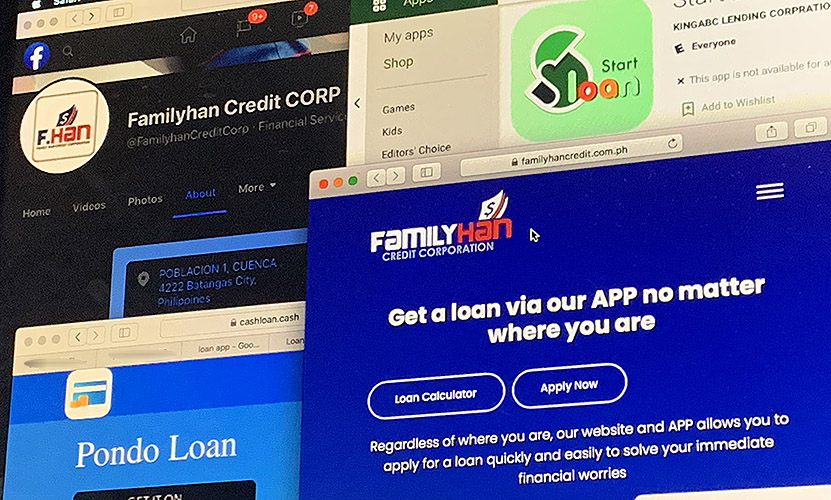

The Securities and Exchange Commission (SEC) has recently shut down the operations of KingABC Lending Corp., the company behind the online lending platforms Pondo Loan, Start Loan, Green Loan, Loan Club, and Familyhan Credit Corp., having been found to have committed unfair debt collection practices, threatening borrowers on social media and various online platforms on made-up legal basis.

“Their liability should not only be administrative as some of the acts committed against the financial consumers already constitute criminal accountability such as infringement of data privacy and cyber harassment just to name a few,” the Vice Chairperson of the Senate Committee on Banks, Financial Institutions and Currencies said.

In Gatchalian’s Senate Bill No. 2287 or the proposed “Financial Products and Services Consumer Protection Act”, financial service providers are prohibited from employing abusive collective or debt recovery practices and must respect the privacy and protect the data of their clients.

Imprisonment of not less than one year and not more than five years or a fine of up to P2 million or both at the discretion of the court will be slapped against any person who violates the provisions of the bill or any related rules, regulations, orders or instructions issued by the financial regulators.

Financial regulators such as the Bangko Sentral ng Pilipinas (BSP), SEC, and Insurance Commission (IC) shall have the authority to impose enforcement actions on their respective supervised financial service providers such as restriction to collect excessive or unreasonable interests, fees, or charges; and imposition of fines, suspension, or penalties for non-compliance with this Act; among others.

A financial regulator, consistent with public interest and the protection of financial consumers, is authorized to institute an independent civil action on behalf of the aggrieved financial consumers, the senator said.